Are You Getting the Best Value from Your Payroll Software?

Managing payroll efficiently is critical for every business, but choosing the right software requires balancing costs with features and benefits. This guide provides an in-depth cost-benefit analysis of popular payroll software, helping you identify the best value for your business.

Why Conduct a Cost-Benefit Analysis?

A thorough cost-benefit analysis ensures:

- Informed Decision-Making: Understand what you’re paying for and the return on investment (ROI).

- Cost Control: Avoid overspending on unnecessary features.

- Optimized Efficiency: Invest in tools that improve processes and reduce errors.

Factors to Evaluate in Payroll Software

1. Pricing Structure

- Base Fees: Monthly subscription costs.

- Per Employee Charges: Additional costs based on the number of employees.

- Setup Costs: One-time fees for implementation.

2. Features and Functionality

- Automated tax filing.

- Direct deposit capabilities.

- Employee self-service portals.

- Integration with accounting and HR systems.

3. Scalability

- Does the software support your growth plans?

- Can it handle an increasing workforce or multi-state payroll needs?

4. Customer Support

- Availability of live support, tutorials, and online resources.

- Quality of assistance during critical payroll periods.

Cost-Benefit Analysis of Top Payroll Software

1. Gusto

- Cost:

- Base Fee: $40/month.

- Employee Fee: $6 per employee/month.

- No setup fees.

- Benefits:

- All-in-one HR and payroll solution.

- Automated tax filings and compliance.

- Employee benefits management.

- ROI:

- Ideal for small to mid-sized businesses looking for simplicity and comprehensive features.

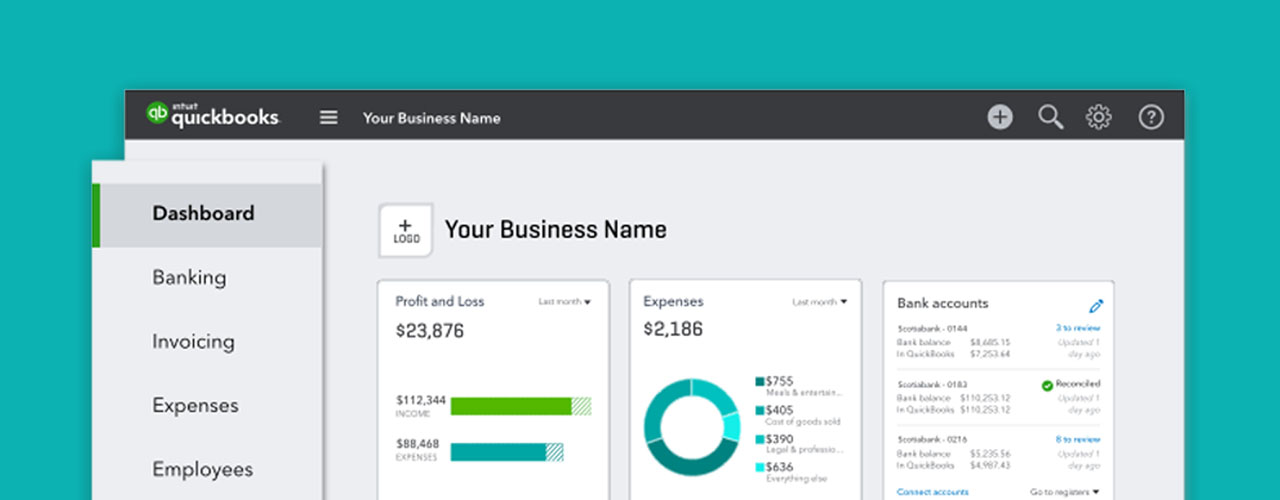

2. QuickBooks Payroll

- Cost:

- Base Fee: $45/month.

- Employee Fee: $5 per employee/month.

- Benefits:

- Seamless integration with QuickBooks accounting.

- Same-day direct deposit.

- Affordable for small businesses using QuickBooks.

- ROI:

- Great for businesses already using QuickBooks for accounting.

3. Paychex Flex

- Cost:

- Custom pricing based on business size.

- Benefits:

- Comprehensive payroll and HR management.

- Scalable for mid-sized and large businesses.

- 24/7 customer support.

- ROI:

- Best for businesses with complex payroll needs and larger teams.

4. Patriot Payroll

- Cost:

- Base Fee: $10/month.

- Employee Fee: $4 per employee/month.

- Benefits:

- Affordable and easy to use.

- Tax filing support and employee portals.

- ROI:

- Excellent for startups and budget-conscious businesses.

5. ADP Workforce Now

- Cost:

- Custom pricing for enterprises.

- Benefits:

- Advanced payroll and compliance tools.

- Global payroll capabilities.

- Integration with HR, benefits, and time tracking.

- ROI:

- Perfect for enterprises and businesses with international payroll.

Case Study: Saving Time and Money with Gusto

Scenario: A small marketing agency needed to streamline payroll for 15 employees while maintaining tax compliance.

Solution: Switching to Gusto reduced their payroll processing time by 50%, saving $1,200 annually in administrative costs.

Outcome:

- Automated tax filings eliminated errors.

- Employee self-service portals improved satisfaction.

Steps to Conduct Your Own Cost-Benefit Analysis

1. Identify Business Needs

- Determine critical features like automation, scalability, and integrations.

- Evaluate compliance requirements for your industry.

2. Calculate Total Costs

- Include base fees, per-employee costs, and setup fees.

- Account for any hidden charges (e.g., additional reporting tools).

3. Evaluate Potential Savings

- Estimate time saved by automation.

- Calculate reductions in tax penalties or errors.

4. Compare ROI

- Balance upfront costs with long-term benefits.

- Consider intangible benefits like employee satisfaction and reduced stress.

Common Mistakes to Avoid

- Focusing Solely on Price

- Cheap software may lack essential features.

- Invest in value, not just affordability.

- Ignoring Scalability

- Ensure the software can grow with your business needs.

- Overlooking Hidden Costs

- Watch for fees for integrations, additional users, or support.

Final Thoughts

Choosing payroll software is an investment in your business’s efficiency and compliance. By conducting a cost-benefit analysis, you can identify the best value solution that meets your unique needs. From Gusto’s all-in-one simplicity to ADP’s enterprise-grade tools, there’s a solution for every budget and requirement.