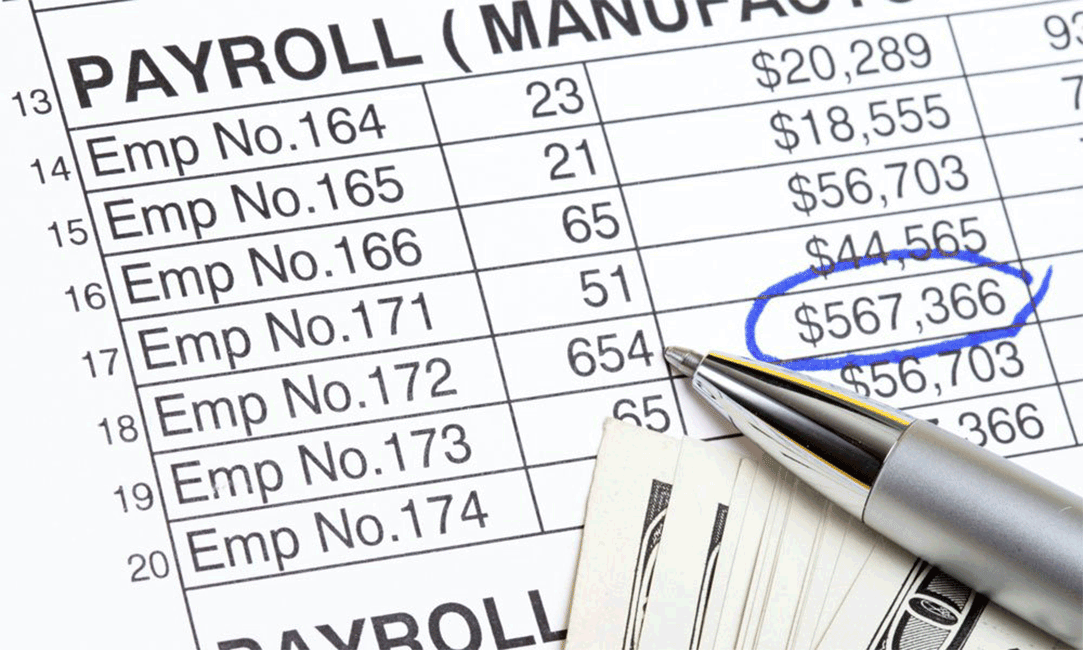

Calculating payroll checks can be daunting if you do not know how to do it properly. This brief overview provides a summary for calculating payroll checks so you won’t be at a loss when it comes time to pay the employees and cut checks.

If for some reason you opt to not go with the latest accounting application with a an additional payroll component, you will find yourself needing to calculate payroll checks. Barring you don’t have a payroll processing company already calculating the payroll.

While it is often stated that payrolls are complicated, when you know the figures and have the basics covered, unless you have a really complicated benefits package or have a unique situation calculating payroll checks can be simple.

The Basics of Calculating a Payroll Check

- Your employee completes a W-4 Form. This document enables you to pay the proper amounts to each employee. Important things to note here are the employee’s name, address, social security number or tax id, selected exemptions and marital status.

- From there you can calculate gross wages by taking the hourly wage and multiplying that figure by the total number of hours worked or in the case of an employee who is paid by salary, utilizing their annual wages divided by the number of times the employee is paid as the starting point for deductions. A regular work week for hourly employees is 40 hours. Hours worked beyond that are considered overtime and must be calculated as such.

- Next, you calculate the payroll reductions. The first calculations are the voluntary reductions that the employee indicated when they completed W-4 and/or other forms. The amounts you calculate here are to be retrieved from the employee’s gross pay and are non-taxable. (As a side note: Federal Income Tax is calculated from gross pay after these reductions.)

- The second payroll deductions are the statutory payroll taxes mandated by federal and state law. These amounts differ for each employee because they based on each individual employee’s claimed deductions, filing status and state. Check with your individual state to determine the tax rate if any that must be paid.

- Voluntary deduction that the employee has declared come next. These include but are not limited to; 401k benefit plans, tuition payments, health insurance and direct deposits. The deductions made here impact net pay, but have no bearing on gross pay of the employee.

- Lastly, you take all of the figures you have compiled and subtract them to arrive at the net pay.

Consider Your Options

To ensure proper deductions and calculations be sure to use the appropriate state and federal taxation publications for your situation. While it is possible to calculate payroll checks manually, payroll software speeds the process of calculating payments to employees and reduces the possibility of error. Also you have the option of outsourcing payroll services and hiring a payroll processing company to calculate payrolls for you.